Six Ways to Improve Financial Service Client Relations with SMS & Email

Digital communication challenges and solutions

People crave connection in business. Eighty percent of consumers report that the experience a company provides is just as necessary as its products or services and 90% of consumers want to communicate with businesses via text messaging. Social distancing measures due to COVID-19 highlights this consumer need even more.

A positive client experience entails:

- Establishing trust

- Providing quick personalized responses with action-oriented, thorough fixes

- Proactive communication

For financial service professionals, building relationships by curating positive client experiences is at the core of their success. Asset managers, wealth advisors, financial planners, and mortgage lenders are continuously communicating with their clients to keep business moving forward. Hence, they need to have an overview of and insight into all client communications: they need to know who said what last.

Research shows that the majority of clients consider the need to explain or relay information to more than one team member as a sign of poor customer service. The expectation amongst clients is that the person they're speaking to at the financial institution will have access to relevant historical client records and conversations. Match My Email (MME), and Mogli (an SMS & WhatsApp™ text messaging application) help these professionals automatically track conversations in Salesforce.

The importance of cohesion and collaboration in client-facing conversations

MME is a cloud-based app that sits in between your email and your Salesforce org. AI enables MME to automatically capture and store emails into their relevant records in Salesforce. The app eliminates duplicate emails in Salesforce, creates email meta-data that tracks email activity by customer or user, and matches unique attributes like names, words, or numbers within an email's content to Salesforce records.

Get your free copy of Mogli and MME's infographic for improved Financial Services communications!

MME operates seamlessly with Salesforce's Financial Cloud. Excuses like "I wasn't CC'd on the email, so I don't know what was said to the client," are no longer valid excuses. When your team's emails are always available in Salesforce, you'll be able to pick up exactly where the conversation left off. Wealth advisors, asset managers, and other financial services professionals rely on MME to capture emails in Salesforce for cohesive communications.

Similarly, Mogli's Conversation View allows unlimited Salesforce users to text clients, coded by color and avatar. Regardless if these text-based conversations happen via one-on-one conversations, bulk messaging, surveys, reminders, or text-to-pay, they're all stored within the Contact Record for easy reporting. Additionally, Mogli supports all Custom and Standard Salesforce Objects, including Person Accounts. So, regardless of your Salesforce org customizations, Mogli supports your communication workflow.

Six ways to proactively communicate by combining text messaging and email on Salesforce

It's important to note that clients can manage their preferences between communication channels. They can opt-in or opt-out of text or emails at any time.

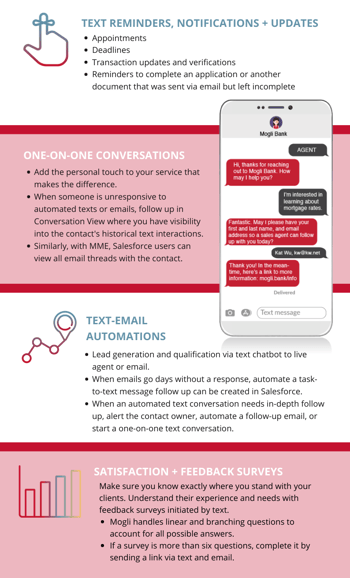

- Text clients reminders for appointments or deadlines.

- Both text and email updates for peace of mind.

- Automated text reminders to complete an application that was sent via email but left incomplete.

- Use flow or process builder Salesforce automation for text-initiated lead generation and lead qualification or any other text-to-email sequences. For example, send a text message to capture vital information quickly, then follow up with an in-depth email.

- Provide a personal follow-up in a one-on-one text conversation when someone didn't respond to an email.

- Initiate a feedback survey sent via text message, and if the survey is long or left incomplete, follow up via email for completion.

If you use Gmail, you probably have seen this prompt: "Sent X days ago. Follow up?" One of G-Suite's more recent features, the reminder to follow up, can save emails from slipping through the cracks. Now, using Salesforce's Process Builder, MME, and Mogli, finance professionals can recreate this function in Salesforce. When emails go days without a response, a task to text message follow up can be created in Salesforce. If a client's not responding to their emails, move the conversation to mobile. With automatic email and SMS capture, advisors have the assurance that business conversations with their clients are logged in Salesforce effortlessly.

The ROI of strong client relationships for finance professionals

Building strong relationships means increasing the assets under your management: McKinsey & Company found that customers base "70% of buying experiences on how they feel they are being treated." Once you have those clients, continue to expand upon that relationship because attracting new clients is about six times as expensive as retaining happy clients.

To attract new and delight existing clients, you have to have confidence in the quality of your CRM's information. Historical and omniscient views of both text and email communication on which you can easily report are paramount. Asset managers can spend less time on the menial and more time on the meaningful with 100% reliable email capture and robust text messaging abilities via SMS or WhatsApp in Salesforce.

To attract new and delight existing clients, you have to have confidence in the quality of your CRM's information. Historical and omniscient views of both text and email communication on which you can easily report are paramount. Asset managers can spend less time on the menial and more time on the meaningful with 100% reliable email capture and robust text messaging abilities via SMS or WhatsApp in Salesforce.

Claim your copy of our infographic:

Additional resources:

- Mogli + MME Demo-Webinar

- 10 Ways Financial Services on Salesforce Boost Business with Text Messaging

- Mogli for Financial Services

Want to see how Mogli works with your org?